A Sound Investment

Two local Realtors® and investors give their perspective on why you should buy in the South Bay.

- CategoryAdvertorials, Homes, People

- Written byJenny Morant & Tyler Morant

- AbovePhotographed by Steve Gaffney

Jenny Morant, Tyler Morant & Devon Stull. Photographed by JP Cordero.

As Realtors® and real estate investors, we believe that owning a home in the South Bay is an investment that goes beyond happiness and housing security. It will also generate a positive financial return. With commercial real estate taking a dive as companies continue to focus on work-from-home lifestyles, we see single-family homes as the most profitable type of real estate investment currently available in Los Angeles.

At the Jenny Morant Group, we are betting on single-family homes as investments that offer less risk with the potential for big gains. Wall Street hedge fund managers and investors agree with our prediction. In this post-pandemic market, the lack of housing supply and endless high demand by buyers who value square footage and a yard create a steady market for an investor. The lack of inventory means homes are still in high demand, selling in multiple offers and over asking price—despite the historic rise of mortgage rates. Regardless of the prospects of recession and the possible future impact on housing prices, we remain optimistic about the potential for single-family homes.

Three Rules of Real Estate Investment

The three rules of real estate investment are location, location, location. The South Bay is a unique market due to its location and amenities. However, the biggest benefit is its proximity to Los Angeles, which boasts one of the most impressive, diverse economies in the United States. This helps insulate the South Bay from being overly impacted by any single major market sector shock, which makes our area one of the most resilient real estate markets in the United States.

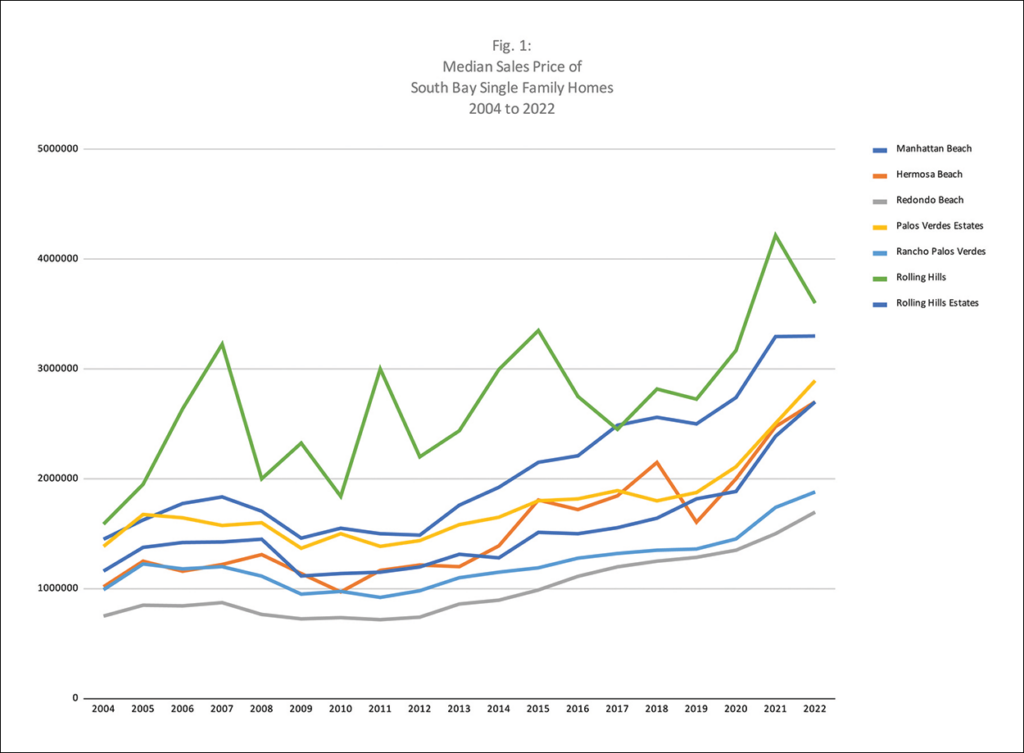

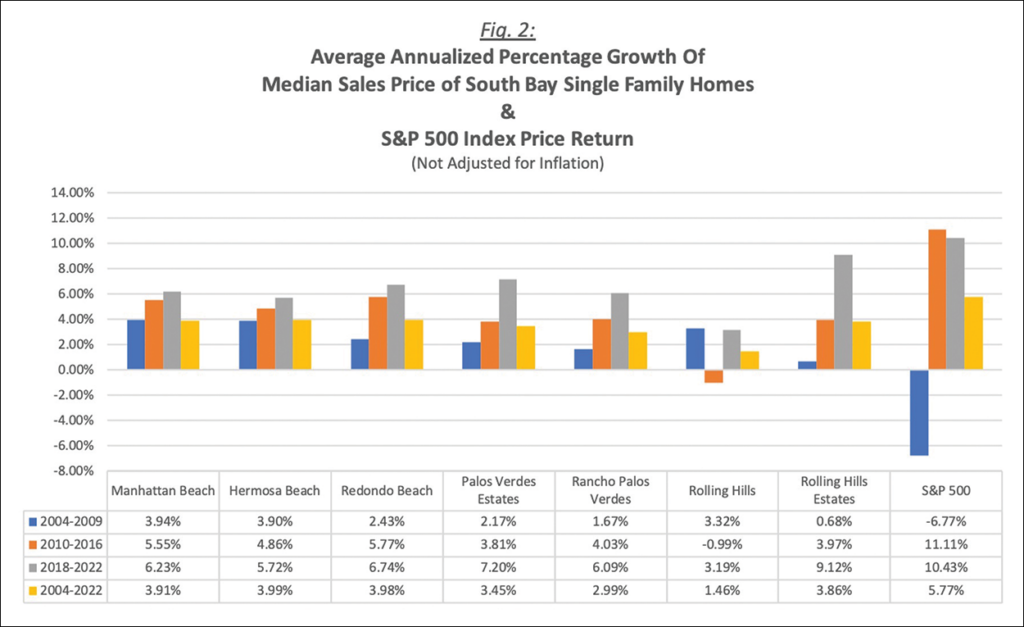

Median home prices have steadily increased in each of the Beach Cities since 2004, as you can see in Fig. 1. Over these 18 years, the average annualized growth in median sales prices in most of the Beach Cities has seen steady increases in both bull and bear markets (see Fig. 2). Our community has also experienced steady growth in the median sales price during the periods leading up to and following the Great Recession (see Fig. 2).

Put Your Money To Work

One of the hardest pills to swallow when buying a home is that it is an illiquid, capital-intensive asset compared to stocks and bonds. Fig. 2 shows that the S&P 500 has significantly higher historical returns than the median home in the South Bay, so sitting on a ton of equity in your home and not putting it to work in another asset class may be disconcerting to you. Despite that fact, the South Bay housing market generally performs better during those times that the S&P 500 is down. This is why leveraging your home (getting a mortgage) can create a great opportunity to put your money to work without having to put too much into your purchase and create future opportunities for liquidity.

Leveraging your home is a great way to reduce your risk and utilize less of your own cash when purchasing your home. Since the South Bay housing market is a lower risk market that experiences regular increases in the median sales price, you might consider taking advantage of a shorter-term, interest-only mortgage instead of a 30-year fixed rate mortgage. A 30-year fixed rate mortgage is generally more expensive than an interest-only mortgage because you will be paying down the principal of your mortgage in addition to the interest. That means you will have a higher monthly housing cost than you would with an interest-only loan.

You may want to bet that you will gain additional equity in your home just by virtue of the natural market forces, as evidenced by the average annualized growth of prices of South Bay housing prices in Fig. 1. Why pay cash to gain equity when you can let the market do it for you? You can always refi the property before the mortgage matures.

Another way to put your money to work is to take advantage of cash-out refis whenever interest rates drop and/or prices go up. This is a good way to create liquidity without incurring the significant costs associated with selling your home. You can always use the proceeds of the cash-out refi to purchase another local property as an investment property, which is what we prefer to do ourselves.

Plan Your Future

It is best to plan in advance how long you plan to live in your home and what you plan to do when you move (e.g., rent it, sell it, leave it to your children). That will help you make the most out of your investment. There are multiple ways to best leverage even your own primary residence as an investment. Contact us for a personalized analysis of your own real estate portfolio (current or future).